¶ Usage Rates

Usage Rates are the most important type of charge in smartbilling; they are applied to a Subscription account for the usage component of the service.

For example, Phone Services would have usage rates for calls on a per-minute or per-second basis;

Internet Usage might include data download per MB, etc. smartbilling allows users to define the Subscription usage rates and collects the data from suppliers to calculate exactly how to invoice the customer

There are number of parameters or types, which can be used while defining usage charges.

For example, cellular phones used to be offered with calling plans that included different rates for calls during the daytime (peak times), and were charged at higher rate than calls made during night time or on weekends (off peak).

In another example, many of today’s VoIP service offerings charge different rates for calls terminating within the operator’s owned or peered networks, (On-Net), would be charged at lower prices than ‘switched’ calls that must travel over the PSTN (Public Switched Telephone Network) shared between all carriers.

smartbilling provide lots of flexibility to define rules to account for different usage charges consumed by the customer Usage Rates can currently be invoiced using 3 different strategies:

- A Fixed, per-unit rate with

- an Initial (or minimum) fee plus an incremental per-unit component

- an Included quantity

- the ability to pool usage within a group of subscriptions - A Pass-Through rate, where the cost of the usage indicated in the call transaction is passed on to the customer.

- A variable charge based on a Rate Plan where Fixed or Pass-Through rates are determined by a lookup value (Destination or Volume-Tier).

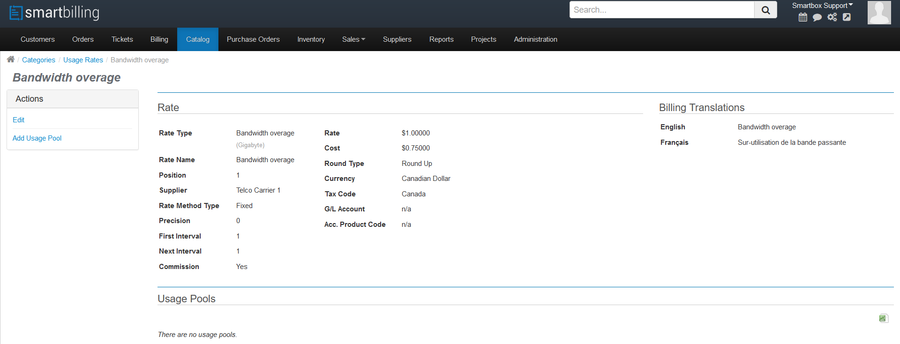

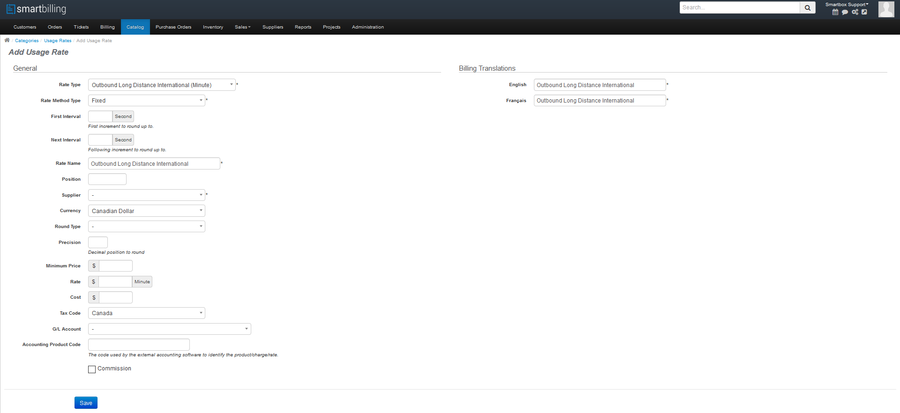

¶ Select a Rate Type

In the General Section of the Rate information page, first select an appropriate Rate Type from the drop-down menu.

Rate Types are determined by how the Usage Import template classifies the different usage transactions. Usage Import templates can be created for different Usage sources according to the user’s specifications, and a customization charge will usually apply.

Rate Types connect the Usage Import template to the Usage Rates used to invoice the usage belonging to a Subscription.

The same Rate Type can apply to more than one source of usage data, and thus be generated by more than one Usage Import template.

Depending upon the Rate Type selected, other fields may appear in the General Section. Fill them in as appropriate. Fields that have an asterisk (*) next to their value box are mandatory, and as a rule, it is good practice to fill in all values, whether or not they are mandatory, and even if the field value is Zero.

Enter Name for the Rate, select a Currency and a Tax Code that apply to the Rate, and finally, enter the G/L Accounting Code with which to associate charges created using this Rate.

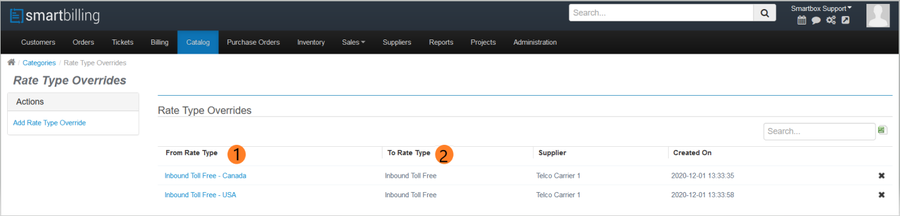

¶ Usage Rate Type Override Table

CDRs can be coded to define the most granular types of call rating, and how the override table can regroup them into less granular ones. E.G. CDR processes calls into Canada On-Net, Canada Off-Net, Canada Premium, USA On-Net, USA Off-Net and USA Premium.

The Usage Rate Types Override table can regroup the granular Rate Types into a variety of Groups. Rates classified by the Usage Import Template (1) (the From Rate Type) can be overridden and mapped to a To Rate Type (2) for a given supplier of usage transactions.

Because the Usage Rate Types Override table entries define a Supplier (i.e. a Usage transaction source), the same customer could have multiple ways of grouping the granular Rate Types together. As in the example below, Inbound Toll-free Canada and Inbound Toll-free USA rates are overridden into a single rate as Inbound Toll-free. Each Supplier (i.e. Usage transaction source) will have its own set of rates that are overridden.

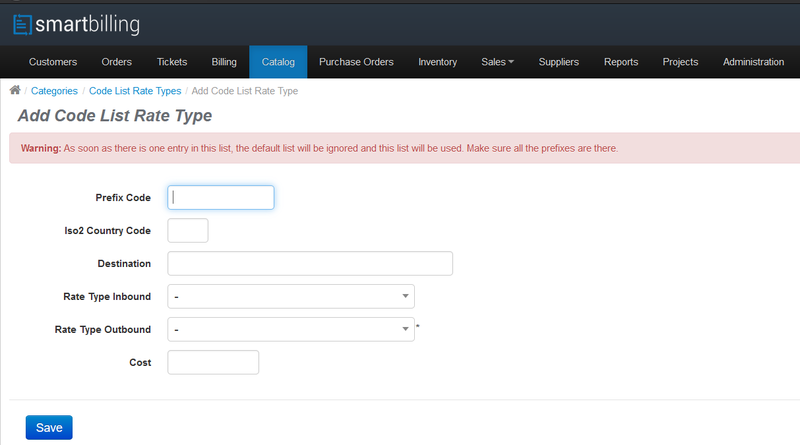

¶ Usage rate Types Code list

smartbilling has a standard table that defines area prefix code and the rate associated to it. If a new Code list rate is added (even a single entry to the list). System will no longer use the values from the predefined table.